Executive Summary

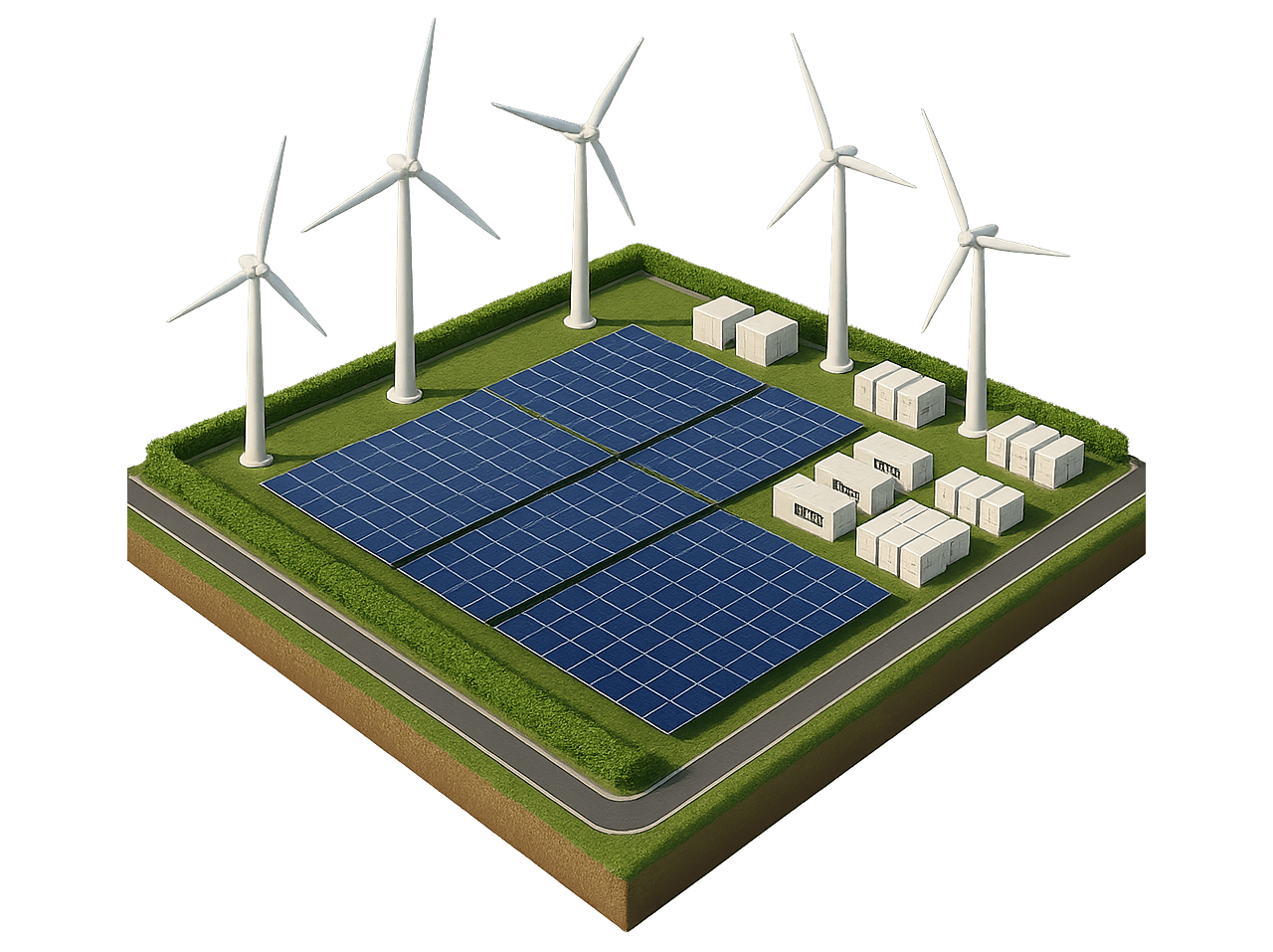

- End-to-end project development: From site identification, permitting, and engineering to construction and commissioning.

- BESS integration: Advanced storage solutions that enable grid balancing, peak shaving, and enhanced project profitability.

- Strategic partnerships: Collaboration with consultants, utilities, and government authorities ensures early access and premium project pipelines.

- High-return investment model: Combining solar generation, energy storage, and ancillary services to maximize yield.

- Transparency: Clear financial models, phased roadmaps, and detailed feasibility studies.

Business Value for Investors

Investors benefit from attractive long-term returns, exposure to a high-demand sector, and hedging against fossil fuel volatility. Energy storage integration significantly increases profitability by enabling participation in energy markets such as capacity, frequency regulation, and arbitrage. This diversification creates resilient and future-proof portfolios.

Market Context

By 2030, the EU targets over 45% renewable energy penetration, with energy storage capacity expected to expand rapidly. Eastern Europe, in particular, offers untapped potential with growing solar PV capacity and government incentives. Coupled with EU-wide support mechanisms, the region presents exceptional opportunities for early investors in solar + storage infrastructure.

Investment Advantages

- High ROI: Projects designed with 5–7 year payback horizons.

- Scalable portfolio: Opportunities range from 10 MW to 200+ MW solar farms with integrated storage.

- Risk mitigation: Long-term Power Purchase Agreements (PPAs) and diversified revenue streams.

- Strategic location: Direct access to Eastern European markets with growing electricity demand.

- Green impact: Active participation in Europe’s decarbonization and ESG commitments.

Next Steps

Contact us to request a customized feasibility study, financial modeling, and ROI projections for available projects. We provide detailed risk analysis, partnership structures, and operational roadmaps to support your investment decision.

⚡ In short, Solar and Energy Storage Investments in Europe are not only profitable but also strategically aligned with global energy trends. By combining solar PV with battery storage, investors capture higher margins, unlock new markets, and contribute directly to a carbon-neutral future.

FAQ — Solar and Energy Storage Investments

1) Why invest in solar and energy storage?

Because combined projects deliver higher profitability, market flexibility, and long-term stability compared to standalone renewables.

2) What is the expected ROI?

Typical returns range from 10–15% IRR with a 5–7 year payback period, depending on project size and market conditions.

3) Which countries in Europe offer the best opportunities?

Eastern Europe (Romania, Poland, Hungary) and Southern Europe (Spain, Italy, Greece) currently offer attractive incentives and grid demand.

4) What role does BESS play in solar projects?

BESS balances intermittent solar generation, enables energy trading, and provides grid services like frequency regulation and peak shaving.

5) How are risks managed?

Through long-term PPAs, diversified revenue streams, phased investment, and collaboration with trusted local partners.

6) How large are typical projects?

From 10–50 MW for mid-scale investors to 100–200+ MW utility-scale projects with integrated storage.

7) What financing options are available?

Equity, debt financing, green bonds, and co-investment structures tailored to investor profiles.

8) How does this align with ESG goals?

Solar + storage projects contribute directly to carbon reduction, SDG targets, and sustainable investment portfolios.

9) Are these projects grid-connected?

Yes, projects are designed for full grid integration with CE/IEC-compliant equipment and local approvals.

10) What support do investors receive?

Customized feasibility studies, ROI models, permitting assistance, and turnkey EPC partnerships ensure transparency and success.